The Investment Tax Credit (ITC) is a federal solar incentive that has helped make solar energy more affordable for homeowners and businesses across the United States. The ITC is also known as the Solar Investment Tax Credit (SITC) or the Solar Tax Credit. We will explore the details of the ITC, how it works, and how you can take advantage of this solar incentive.

What is the Investment Tax Credit?

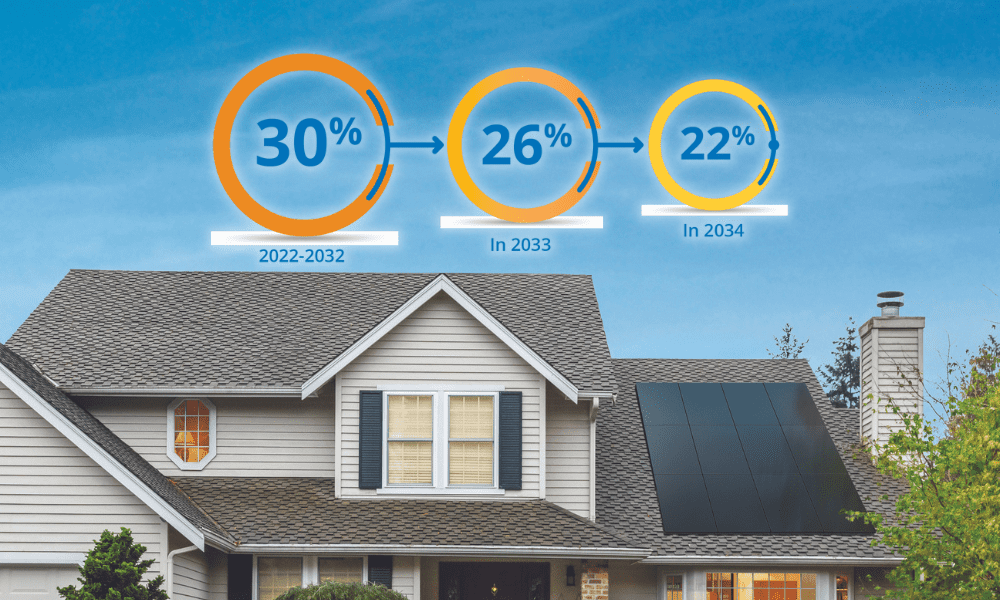

The Investment Tax Credit is a federal tax credit that allows homeowners and businesses to deduct a portion of the cost of installing a solar energy system from their federal taxes. The credit is worth 30% of the total cost of the system, including installation, and can be used to offset the taxpayer’s federal income tax liability.

How does the Investment Tax Credit work?

The ITC is a credit, not a deduction, which means that it directly reduces the amount of tax owed by the taxpayer. For example, if you install a solar system that costs $20,000, you can claim a tax credit of $6,000 (30% of $20,000). If your federal income tax liability for the year is $10,000, the ITC will reduce your tax liability to $4,000.

The ITC is available for both residential and commercial solar installations, and there is no cap on the credit amount. However, the credit is set to begin phasing out after 2032.

How can you take advantage of the Investment Tax Credit?

To take advantage of the ITC, you must first install a solar energy system on your property. The system must be placed in service by December 31 of the tax year in which you claim the credit. You can claim the credit on your federal income tax return using the correct IRS Form for Energy Credits.

If you don’t have enough tax liability to claim the full credit in one year, you can carry forward any unused credit to future tax years. However, the credit can be carried forward for a maximum of five years.

Conclusion

The Investment Tax Credit is a valuable federal incentive that can help make solar energy more affordable for homeowners and businesses. By taking advantage of the ITC, you can save thousands of dollars on the cost of installing a solar energy system. If you’re considering installing a solar system, be sure to talk to your tax professional about how the ITC can help you save on your federal taxes. Contact us for information about the ITC and other solar incentives.

How much will solar cost you?

Find out. It’s FREE!